Since 2002, PetPartners is a name synonymous with pet care and dependable pet insurance.

Ever since the company was founded, pet parents have had a better chance of dealing with their pet’s vet bill in a less stressful manner.

Due to the variety of pet coverage options, PetPartners is a suitable choice for pet owners of all economic groups. Given that every pet is unique, every pet insurance policy should be as well. PetPartners’ business model revolves around providing a large number of optional add-ons, so everyone can choose only what they can afford and actually need.

The PetPartners team is full of committed pet lovers making each customer’s pet parenthood a calm and enjoyable experience, even in times of accidents and health emergencies.

This PetPartners pet insurance review will help you understand how their coverage works and what you can do to make it more complete. You’ll also learn what their other features are, how much they cost, and how they compare to other top players in the pet insurance industry.

PetPartners’ Pros & Cons

| Pros | Cons |

|---|---|

| No veterinary exam is required prior to enrolling with PetPartners | Long waiting period for orthopedic conditions |

| Short waiting period for accident coverage | Bilateral conditions are excluded from coverage if one side is pre-existing |

| Pet insurance travel coverage is available for Canada | Pets older than 8 aren’t eligible for the accidents and illnesses coverage plan |

| A basic accidents and illnesses coverage option with an affordable premium | Hereditary and congenital conditions are covered only if you purchase the optional add-on |

| Two comprehensive pet wellness plans packages | Exam fees and end-of-life expenses are also covered with an optional add-on that makes this coverage quite expensive |

| An affordable accident-only coverage plan is available for cats and dogs | $3.00 – $4.00 monthly transaction fee (depending on the state) |

| A 24/7 Vet Helpline for all policyholders at no extra charge | |

| 5% multi-pet discount | |

| 30-day free look period |

PetPartners’ Key Attributes

- Underwriter: Independence American Insurance Company

- AM Best Rating: A-

- BBB Rating: A+

- Exam period: A thorough veterinary exam of your pet isn’t required by PetPartners in order to become eligible for enrolling with them. However, if your veterinarian prescribed an annual veterinary exam for your pet, you must consider it, as per PetPartners’ policy conditions;

- Increase in monthly premium: As is the practice with all pet insurance companies, PetPartners might increase the price of your premiums as your pet gets older and as costs of veterinary services in your area of residence rise over time. Despite this, PetPartners claim that they’ll never increase your premiums based on the number of claims you file with them;

- Claim submission time limit: To become eligible for reimbursement of a certain veterinary treatment performed for your pet, you must submit an insurance claim to PetPartners within 180 days of the date of the treatment;

- Claim processing times: PetPartners will process a successfully submitted claim within 14 days, however, most of the time this period averages on about 7 days in total. So, from the moment you file your claim, there will be about a week until you receive your reimbursement payment from PetPartners;

- Waiting periods: PetPartners imposes the usual 14-day waiting period that you must fulfill for any eligible illness to become coverable by their insurance policy. On the other hand, the waiting period for accidents is much shorter – you only need to wait 3 days after enrolling with PetPartners to be able to get covered for accidents and injuries. Orthopedic conditions like IVDD and those that affect cruciate ligaments have a waiting period of 6 months.

- Accidents – 3 days;

- Illnesses – 14 days;

- Wellness – no waiting period;

- Orthopedic conditions – 6 months.

- Pet insurance coverage with PetPartners is valid in Canada, besides the USA;

- Bilateral conditions which affect both sides of a pet’s body such as cruciate ligaments, lameness, cherry eye, hip dysplasia, osteochondritis dissecans, etc. are excluded by PetPartners.

PetPartners’ Insurance Plans

There’s definitely a lot that PetPartners has to offer. Because of their confusing policies for what’s available in different states, potential customers might become overwhelmed and lose track of what they can benefit from, but we did all the leg work here and you can rest assured you’ll have the right information.

PetPartners provides two base pet insurance plans for cats and dogs – CompanionCare, for cats and dogs younger than 9, and AccidentCare for cats and dogs 9 and older.

There are many other optional add-ons for extra care which we’ll cover below as extra features.

CompanionCare

The CompanionCare plan provides coverage for accidents and illnesses, so you can rely fully on taking care of your pet without worrying about the costly veterinary bills.

Any pet between 8 weeks and 9 years can enroll in this plan and enjoy its flexibility.

The waiting period for illnesses is 15 days, the one for accidents and injuries is 3 days, and that for IVDD and cruciate ligament-related conditions is 6 months.

The many coverage limit options allow you to build your own insurance plan so you don’t pay for what you don’t want or need. Here’s what’s available for the CompanionCare plan:

- Annual coverage limits: $2,500, $5,000, $7,500, $10,000, $15,000, $20,000, or Unlimited;

- Annual deductibles: $100, $250, $300, $400, $500, $600, $750, or $1,000;

- Reimbursement percentages: 70%, 80%, or 90%.

What’s great about this plan is that, besides the customizable options listed above, there’s a fixed basic coverage option called CompanionCare Lite, created for a truly affordable alternative. The option isn’t customizable, but has a $100 deductible, 80% reimbursement rate, and allows unlimited incidents. However, it’s crucial to remember that this option imposes a $500 per-incident limit. That means that you can be reimbursed more than $500 on a single claim.

AccidentCare

The AccidentCare plan guarantees coverage for all unexpected accidents and injuries that need treatment so your pet’s health isn’t compromised.

The plan’s primary purpose is to offset at least some of the costs of veterinary care for senior pets. Only pets that are 9-year-old and above can enroll in it.

As illnesses and other chronic conditions are excluded, the waiting period on this plan is only for accidents and it’s 3 days.

Unlike the CompanionCare plan which is characterized by a broad flexibility, the AccidentCare plan has fixed claim options. It is characterized by having a $100 deductible, 90% reimbursement, and unlimited annual claim payout.

What’s Covered With a PetPartners Policy

The CompanionCare plan covers the costs for veterinary treatments for a vast number of unexpected accidents and illnesses.

While lots of conditions enter the list of covered incidents, you’ll notice that entire sections that are important to a pet’s life are missing from PetPartners’ base policy. That’s because PetPartners’ business model is built around adding optional add-ons for a more comprehensive coverage.

The following are the benefits that are included in the base PetPartners pet coverage:

- Accidents – physical injuries such as cuts, bruises, burns, bites, wounds, fractures, and internal organ damage such as poisoning, foreign body ingestion, and many more;

- Illnesses – digestive issues, diarrhea, vomiting, dermatitis, ear and eye infections, heartworm, urinary tract infections, and many more;

- Chronic conditions – hypothyroidism, epilepsy, asthma, allergies, and more;

- Cancer – chemotherapy and radiation treatments;

- Dental coverage for accidents that result with damage of permanent teeth and require their professional extraction;

- Alternative and complementary therapies – holistic and behavioral care, hydrotherapy, acupuncture, physical therapy, chiropractic, herbal supplements, vitamins, and more (this type of coverage has a 30-day waiting period and an annual limit of $1,000 for behavioral issues);

- Prescription medications;

- Surgery and hospitalization;

- Diagnostic treatments and laboratory tests – specialists consultations, X-rays, CT scan and MRIs, ultrasound, urinalysis, blood panel, and more;

- Emergency ground transportation using a pet ambulance in the case of an emergency situation;

- Euthanasia that is recommended by a veterinarian.

What’s great about this plan is that pre-existing conditions can be reinstated if a waiting period of 365 days is satisfied without the considered medical condition appearing with visible symptoms.

The AccidentCare plan focuses on the accidents part of the coverage that we mentioned above. So, you can expect things like lacerations, toxic ingestion, eye injuries, broken bones, snake bites, sprains, bee stings, and more similar conditions to be covered. Besides, any diagnostic testing, laboratory exams, surgeries, hospitalization, and prescription medications will be covered if they are needed for an injury to be taken care of.

What’s Excluded From PetPartners’ Coverage

All pet insurance companies provide pet insurance coverage for medical conditions and costs that arise from unplanned veterinary visits. Everything that you plan to take to improve or maintain your pet’s health isn’t covered. Conditions that were present before you enrolled with the insurer are also excluded.

The following list contains every instance that you can’t receive reimbursement for. Some of the entries can be purchased as optional add-ons though, so you can add them to your coverage and enrich your policy.

- Pre-existing conditions;

- Bilateral conditions that are also pre-existing in one side of the pet’s body won’t be covered for the other side either;

- Intentionally inflicted injury or illness to your pet by you or a member of your close family;

- Cosmetic and elective treatments such as ear cropping and tail docking, with the extension of grooming, nail clipping, bathing, and more;

- Anal gland expression;

- Mouth and dental conditions such as dental cleaning, gingivitis, periodontitis, root canals, and more;

- Pet food and diets even if they are prescribed by a veterinarian;

- Experimental procedures such as organ transplants or prosthetics;

- Conditions resulting from activities such as guard security, track or sled racing, law enforcement, fighting, or working;

- Breeding, pregnancy, whelping, and nursing-related issues;

- Veterinary exam fees (optional add-on);

- Hereditary and congenital conditions (optional add-on);

- End-of-life expenses like cremation and burial (optional add-on);

- Preventive care (two optional add-ons).

PetPartners’ Wellness Plans

Oftentimes, you and your friends or family would talk about a number of things that should be provided to your pet in order for them to enjoy a healthy, long, happy life. It’s always best to discuss what’s best for your pet and decide on the routine care plan that you should follow for them.

It’s great if you do this as soon as you acquire your pet. PetPartners can greatly help set up a budget for this purpose, so whenever you have an upcoming preventive or routine procedure for your pet, you’re always covered for it.

The company offers two wellness plans (Defender and DefenderPlus) that provide a variety of preventive care benefits. We’re showing everything that comes on both in the table below. Note that every benefit has a fixed annual amount that if you satisfy before the end of your policy cycle, you won’t be able to be covered for the benefit in question until the next cycle.

| Treatment/Procedure | Defender | DefenderPlus |

|---|---|---|

| Rabies Vaccination | $15 | $15 |

| Flea/Tick & Heartworm Prevention | $80 | $95 |

| Vaccination/Titer | $30 | $40 |

| Wellness Exam | $50 | $50 |

| Heartworm Test of FELV Screen | $25 | $30 |

| Blood, Fecal, Parasite Exams | $50 | $70 |

| Microchip | $20 | $40 |

| Urinalysis or ERD | $15 | $25 |

| Deworming | $20 | $20 |

| Spay/Neuter or Teeth Cleaning | $0 | $150 |

| Total Benefit Value | $305 | $535 |

It’s great that the benefits that come with these two wellness plans are not subject to a reimbursement rate and a deductible.

The prices for the Defender wellness plan are $17/month for all states except Florida where it is priced at $16/month.

The DefenderPlus wellness plan is priced at $30/month for Florida residents and $29/month in all other states.

Extra Features

PetPartners is one of the companies that offer a great deal of extra features in regards to extending your base pet coverage plan than most other pet insurance providers.

They are all optional and you can choose to add them to your PetPartners policy to be able to cover more medical conditions for your pet.

ExamPlus

The ExamPlus optional add-on is an excellent choice to cover office visits and exam fees at any pet clinic in the country, whether that’s a primary care unit, a specialty clinic, or a pet emergency hospital.

Visiting a vet for only a checkup or a full physical exam can usually cost anywhere between $30 to $200 for a single visit. This add-on will enable you to receive reimbursement for the vet bills of these instances.

Remember that this is an optional rider to your basic pet coverage, so it is subject to your usual waiting periods, deductible, and reimbursement rate. It is, of course, only valid for exam fees for illnesses and injuries that are covered by your PetPartners policy.

HereditaryPlus

The HereditaryPlus optional add-on has a purpose to complete your pet coverage and add benefits for inherited and congenital medical conditions.

This means that if your pet was born with or develops a serious condition later in life due to a flawed genetic makeup. Some examples include heart disease, hip dysplasia, spondylosis elbow dysplasia, diabetes, eye disorders, arthritis, luxating patella, and many more.

Only pets that are younger than 2 can enroll in this optional rider. The package also has a waiting period of 30 days.

However, the good thing about it is that it isn’t subject to the deductible and reimbursement rate that you agreed upon for your base coverage.

SupportPlus

Separating and paying final respects to your beloved pet is never easy. The SupportPlus optional add-on ensures you are always taken care of in the time when you need support the most. It provides coverage for your pet’s cremation, burial, urns, and/or memorial after their death, so you can say proper goodbye with dignity and respect.

This optional rider has a fixed price of $2/month that’s added to your initial premium’s price.

Only pets that are under 5 can acquire this rider which is not subject to any deductible or reimbursement rate. However, you need to remember that you need to observe your base coverage waiting periods. The add-on has a maximum benefit value of $300 as well.

24/7 Vet Helpline

You never know why an issue concerning your pet’s health might arise. And having an immediate support channel is always handy that eliminates the need to abandon plans and take a trip to the vet’s office.

That’s what the 24/7 PetPartners Vet Helpline is for. Every PetPartners policyholder can use it to access a non-stop veterinary support to ask everything related to their pet’s health at no extra charge.

While you cannot use this helpline to get a diagnosis or a prescribed treatment for your pet, you can ask for advice about their general health, behavioral changes, nutrition, training, or ask whether you should visit a vet.

PetPartners’ Pricing Quotes

Pulling pricing quotes for various dog and cat breeds of different ages and areas of residence made us realize that PetPartners is neither too expensive nor cheap compared to similar services in the same industry.

Prices depend largely on the pet’s location and age, but their breed plays an important role as well. Purebred cats and dogs have considerably higher premiums than mixed-breed ones due to the higher risk of developing medical conditions purebreds might develop.

Regarding increases in premium prices that will eventually happen over time, the main reasons for higher costs are the pet’s age and the rising veterinary expenses, especially in urban areas.

PetPartners is amazing by offering a large number of customization options that pet parents of different economic backgrounds can afford to insure their four-legged family members. As you can see below in the example charts, PetPartners’ Basic coverage plan is outstanding for providing essential coverage by being truly affordable.

Pricing Quotes for Dogs

| Breed | German Shepherd | French Bulldog | Labrador Retriever |

|---|---|---|---|

| Gender | Male | Male | Female |

| Age | 2 years 4 months | 4 years 2 months | 6 years 6 months |

| Location | New York | California | Colorado |

| Deductible | $500 | $500 | $500 |

| Claim Limit | $15,000 | $15,000 | $15,000 |

| Reimbursement | 90% | 90% | 90% |

| CompanionCare (Accident and Illness Coverage) | $58.12/month | $74.39/month | $73.59/month |

| CompanionCare Basic(Accident and Illness Coverage) | $25.29/month | $32.37/month | $32.03/month |

| Exam Plus (Coverage for Exam Fees) | $9.07/month | $11.78/month | $11.66/month |

*quotes obtained in August 2021

Pricing Quotes for Cats

| Breed | Siamese | Persian | Abyssinian |

|---|---|---|---|

| Gender | Male | Male | Female |

| Age | 2 years 5 months | 4 years 1 month | 8 years 2 months |

| Location | New York | Colorado | California |

| Deductible | $500 | $500 | $500 |

| Claim Limit | $15,000 | $15,000 | $15,000 |

| Reimbursement | 90% | 90% | 90% |

| CompanionCare (Accident and Illness Coverage) | $36.46/month | $29.61/month | $47.70/month |

| CompanionCare Basic(Accident and Illness Coverage) | $15.87/month | $12.89/month | $20.76/month |

| Exam Plus (Coverage for Exam Fees) | $5.69/month | $4.69/month | $7.56/month |

*quotes obtained in August 2021

Discounts and Savings

It’s nice to learn that PetPartners offer a 5% discount if you sign up for two or more pets with them. This discount, although a bit less than other companies who offer a 10% multi-pet discount, is still a good way to save on your monthly costs.

There’s also a 30-day free look period that enables you to try and test PetPartners’ coverage for 30 days and cancel anytime within this timeframe if you’re not happy with the service (given that you didn’t file any claims during this period).

PetPartners offers partnerships with veterinarians, shelters, and rescue centers to enable them to offer a convenient 30-day PetPartners pet insurance coverage to their clients. If your veterinarian that treats your pet or the shelter or rescue center where you adopted your pet offers this coverage, they’ll get you a certificate that you can activate with PetPartners and start using their 30-day coverage.

The 30-day coverage plan is characterized by a $100 deductible, 80% reimbursement rate, and $500 per-incident limit. The waiting period for accidents is 1 day and that for illnesses is 5 days. After the end of the 30-day coverage plan, you can choose to continue your coverage by obtaining a PetPartners base coverage plan.

How Does PetPartners Compare With Its Competitors?

We dedicate this section to comparing companies in order to provide you with more in-detailed insight into how PetPartners responds to what the competition has to offer.

Here, we’ll put PetPartners against Healthy Paws, Pets Best, and SPOT – three seemingly identical but, in fact, quite different pet insurers. What one lacks, another might compensate, so pay careful attention to spot the benefits that are of the highest value to you and your furry companion.

PetPartners vs. Healthy Paws

Healthy Paws is a bit more affordable than PetPartners because it offers better customizability so you can tweak the price of your monthly premium by optimizing your coverage.

However, unlike PetPartners, Healthy Paws doesn’t offer any pet wellness care option nor an accident-only covers plan. They require a full physical exam in order to become eligible for enrollment as well, and a multi-pet discount isn’t listed on their benefits catalog.

| Feature | PetPartners | Healthy Paws |

|---|---|---|

| Coverage Effective | USA and Canada | USA and Canada |

| Reimbursement | Choice of 70%, 80%, or 90% of covered expenses | Choice of 50%, 60%, 70%, 80%, or 90% of covered expenses, depending on pet’s age |

| Co-Payment | 10%, 20%, or 30% | 10%, 20%,30%, 40%, or 50% depending on pet’s age |

| Deductible | $100 – $1,000 | $100 – $1,000 depending on pet’s age |

| Type of Deductible | Annual | Annual |

| Claim Limit Options | $2,500 – Unlimited | Unlimited |

| Accident-Only Plan | Available | Not available |

| Wellness Plan | Available | Not available |

| Unlimited Benefits Plan | Yes | Yes |

| Accidents | Yes | Yes |

| Illnesses | Yes | Yes |

| Illness Waiting Period | 14 days | 15 days |

| Accident Waiting Period | 2 days | 15 days |

| Orthopedic Conditions Waiting Period | 6 months | 15 days (12 months for hip dysplasia) |

| Bilateral Exclusions | Yes | Yes |

| Chronic Conditions | Yes | Yes |

| Hereditary and Congenital Conditions | Optional add-on | Yes |

| Cancer | Yes | Yes |

| Dental Coverage | Accidents only | Yes |

| Prescription Medicine | Yes | Yes |

| Alternative/Holistic Therapy | Yes | Yes |

| Behavioral Issues | Yes | Yes |

| Exam Fees | Optional add-on | No |

| Exam Required for Enrollment | No | Yes |

| Available At Any Vet Clinic | Yes | Yes |

| Microchip | Optional add-on | No |

| Minimum Pet Age Limit | 8 weeks for dogs and 10 weeks for cats | 8 weeks |

| Maximum Pet Age Limit | 9 years for illnesses | 14 years (4 years in New York) |

| Entry Fee | $0.00 | $25.00 |

| Monthly Transaction Fee | $3.00 or $4.00 (depending on the state) | $0.00 |

| Multi-Pet Discount | 5% for multiple pets | Not available |

| Claim Repayment | Within 14 days (7 days on average) | Within 10 days (2-3 days on average) |

| Direct Vet Bill Payment | No | Available |

| Money-Back Guarantee | 30 days | 30 days |

| AM Best Rating | A- | A++ |

| BBB Rating | A+ | A |

*companies compared in August 2021

Read the full Healthy Paws Pet Insurance review.

PetPartners vs. Pets Best

Pets Best lags a bit behind PetPartners when it comes to covering some bilateral conditions. They also don’t offer an option to cover end-of-life expenses, have limited choices for annual claim benefits, and the time they process your claim might take a bit longer than usual.

Other than that, Pets Best is amazing for covering pets regardless of their age. Their accident-only coverage plan has an affordable flat rate, and they also offer insurance for medical devices such as prosthetics and wheelchairs.

| Feature | PetPartners | Pets Best |

|---|---|---|

| Coverage Effective | USA and Canada | USA, Canada, and Puerto Rico |

| Reimbursement | Choice of 70%, 80%, or 90% of covered expenses | Choice of 70%, 80%, or 90% of covered expenses |

| Co-Payment | 10%, 20%, or 30% | 10%, 20%, or 30% |

| Deductible | $100 – $1,000 | $50 – $1,000 |

| Type of Deductible | Annual | Annual |

| Claim Limit Options | $2,500 – Unlimited | $5,000 and Unlimited |

| Accident-Only Plan | Available | Available |

| Wellness Plan | Available | Available |

| Unlimited Benefits Plan | Yes | Yes |

| Accidents | Yes | Yes |

| Illnesses | Yes | Yes |

| Illness Waiting Period | 14 days | 14 days |

| Accident Waiting Period | 2 days | 3 days |

| Orthopedic Conditions Waiting Period | 6 months | 6 months |

| Bilateral Exclusions | Yes | Yes |

| Chronic Conditions | Yes | Yes |

| Hereditary and Congenital Conditions | Optional add-on | Yes |

| Cancer | Yes | Yes |

| Dental Coverage | Accidents only | Yes |

| Prescription Medicine | Yes | Optional add-on |

| Alternative/Holistic Therapy | Yes | Optional add-on |

| Behavioral Issues | Yes | Yes |

| Exam Fees | Optional add-on | Optional add-on |

| Exam Required for Enrollment | No | No |

| Available At Any Vet Clinic | Yes | Yes |

| Microchip | Optional add-on | Optional add-on |

| Minimum Pet Age Limit | 8 weeks for dogs and 10 weeks for cats | 7 weeks |

| Maximum Pet Age Limit | 9 years for illnesses | No limit |

| Entry Fee | $0.00 | $0.00 |

| Monthly Transaction Fee | $3.00 or $4.00 (depending on the state) | $3.00 |

| Multi-Pet Discount | 5% for multiple pets | 5% for each additional pet |

| Claim Repayment | Within 14 days (7 days on average) | Within 40 days (25 days on average) |

| Direct Vet Bill Payment | No | Yes |

| Money-Back Guarantee | 30 days | 30 days |

| AM Best Rating | A- | Unrated |

| BBB Rating | A+ | A+ |

*companies compared in August 2021

Read the full Pets Best Pet Insurance review.

PetPartners vs. SPOT

SPOT is a fairly newer pet insurance provider than PetPartners, but not necessarily inferior. Their orthopedic conditions waiting period is incredibly short (only 14 days), plus they include exam fees and end-of-life expenses in your basic pet coverage policy at no extra cost.

While SPOT has a better multi-pet discount than PetPartners (10% off for each additional pet), their premiums are rather high, especially those of senior pets.

| Feature | PetPartners | SPOT |

|---|---|---|

| Coverage Effective | USA and Canada | USA, Canada, Puerto Rico, Guam, and US Virgin Islands |

| Reimbursement | Choice of 70%, 80%, or 90% of covered expenses | Choice of 70%, 80%, or 90% of covered expenses |

| Co-Payment | 10%, 20%, or 30% | 10%, 20%, or 30% |

| Deductible | $100 – $1,000 | $100 – $1,000 |

| Type of Deductible | Annual | Annual |

| Claim Limit Options | $2,500 – Unlimited | $2,500 – Unlimited |

| Accident-Only Plan | Available | Available |

| Wellness Plan | Available | Available |

| Unlimited Benefits Plan | Yes | Yes |

| Accidents | Yes | Yes |

| Illnesses | Yes | Yes |

| Illness Waiting Period | 14 days | 14 days |

| Accident Waiting Period | 2 days | 14 days |

| Orthopedic Conditions Waiting Period | 6 months | 14 days |

| Bilateral Exclusions | Yes | Yes |

| Chronic Conditions | Yes | Yes |

| Hereditary and Congenital Conditions | Optional add-on | Yes |

| Cancer | Yes | Yes |

| Dental Coverage | Accidents only | Yes |

| Prescription Medicine | Yes | Yes |

| Alternative/Holistic Therapy | Yes | Yes |

| Behavioral Issues | Yes | Yes |

| Exam Fees | Optional add-on | Yes |

| Exam Required for Enrollment | No | No |

| Available At Any Vet Clinic | Yes | Yes |

| Microchip | Optional add-on | Yes |

| Minimum Pet Age Limit | 8 weeks for dogs and 10 weeks for cats | 8 weeks |

| Maximum Pet Age Limit | 9 years for illnesses | No limit |

| Entry Fee | $0.00 | $0.00 |

| Monthly Transaction Fee | $3.00 or $4.00 (depending on the state) | $2.00 |

| Multi-Pet Discount | 5% for multiple pets | 10% for each additional pet |

| Claim Repayment | Within 14 days (7 days on average) | Within 30 days (10-14 days on average) |

| Direct Vet Bill Payment | No | Yes |

| Money-Back Guarantee | 30 days | 30 days |

| AM Best Rating | A- | A |

| BBB Rating | A+ | B |

*companies compared in August 2021

Read the full SPOT Pet Insurance review.

Customer Service

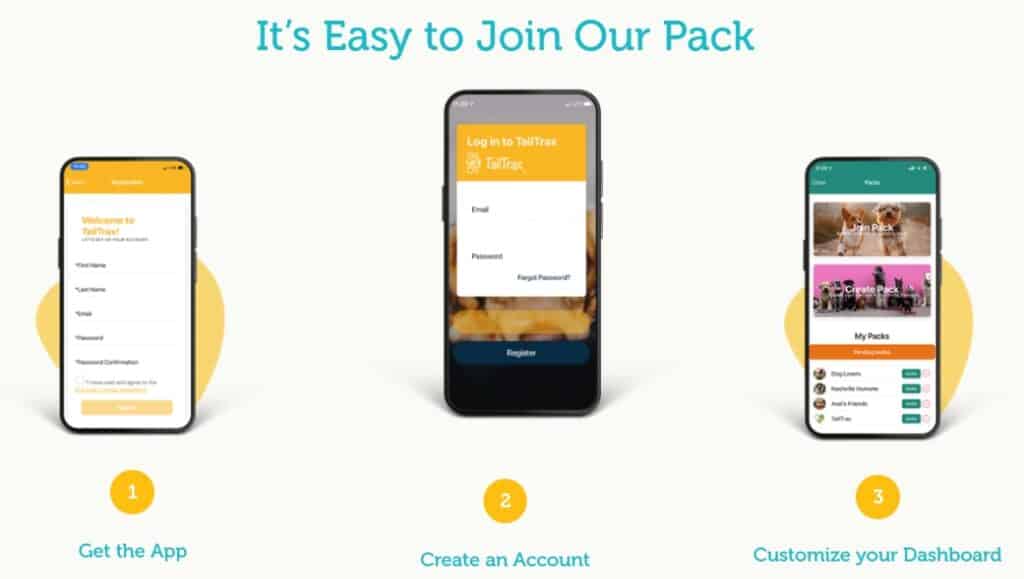

In an age where our lives are increasingly digital, it’s getting more convenient for our pet’s lives to go digital too. PetPartners introduces TailTrax® – a mobile app available for iOS and Android that lets you access your pet’s medical records, submit and track claims, discover pet dog parks, pet sitters, or groomers where you live, find awesome veterinarians, and use the 24/7 vet helpline.

With the TailTrax® app, you can connect with other pet parents and share pictures and videos of your pet. The app offers special discounts to some pet care and pet supply stores making it a very convenient pet resource.

You can also use their other support channels to get in touch with a PetPartners representative. Their email address is help@petpartners.com. Phone (1-866-774-1113) is available Monday through Friday from 8:30 am to 8 pm EST and on Saturdays from 10 am to 3 pm EST.

Customer Reviews

Going over every feature offered by PetPartners and discussing their pricing options and customer service, it’s time we complete this review by diving into what real users have to tell about their time with PetPartners.

In this section, you can witness the real experiences of customers that tell positive and negative stories about how PetPartners handles everything there is regarding pet insurance.

Positive PetPartners Pet Insurance Reviews

PetPartners is truly the best pet insurer you can find. Our Cairn Puppy Mill Rescue girl was recently diagnosed with cancer and we have and will continue to incur significant expenses for her care. PetPartners has been compassionate, transparent, highly responsive, and true to their word. Each claim was completed and reimbursed within a week of submission. Knowing they will be there to help us through this difficult time is an enormous comfort and will enable us to give her the best possible chance at survival.

I’ve had policies with two other insurers in the past. In the few instances where I had to submit claims, they were always challenged or denied on the first attempt, required additional information, and took months to resolve. I felt their cumbersome procedures were intentionally designed so that claimants would give up and not pursue reimbursement.

Keith

I’ve had this insurance since November 2020 for 2 dogs and have been really happy with the plan and the customer service. I called a few times before I bought the plan and the Customer Support reps I spoke to were always really kind and courteous and helped me a ton with my decision making. They were also very knowledgeable with all the fine details too which I appreciated so much! The insurance itself has been a lifesaver for one of my dogs who has had some serious medical issues lately too. Can’t recommend PetPartners enough!

Crystal Dubler

I submitted a claim to PetPartners through their online portal, and it was incredibly easy and user-friendly. I received confirmation of what would be reimbursed from my claim as well as my reimbursement itself in a timely manner.

Alyssa King

I was very impressed with PetPartners as they offer wellness plans which other pet insurance doesn’t as well as covering holistic treatments. The 1st claim I put in was quickly paid by check to me within a week & much more than I expected. I highly recommend this to cover dog expenses.

Diana Beranek

We have had PetPartners insurance for the 10 plus years that we have had our Portuguese Water Dog, Bailey’s Irish Cream. This year we have had a serious problem with Bailey and your firm has been steadfast in its support and prompt in payment of reimbursements. Thank you.

Abe Goldsmith

Negative PetPartners Pet Insurance Reviews

Do your homework before purchasing insurance. I thought I had, but I had not. My dog had cataract surgery and they did not pay one single penny for this surgery. She was diagnosed after I purchased the policy so the pre-existing condition clause does not apply. Even for the reimbursement of preventive care, they did cover the full cost of that and for the total cost of the care, it is cheaper to pay that in full yourself than for what you would pay yearly on a policy. I just canceled mine because they don’t cover what I need them to cover.

I had coverage for preventive care and accident-only. No coverage on illness. The pet has to be under 9 years to start illness coverage. This has been updated from a long and derogatory rant. I reached out again and while I did not get the result I wanted, they were polite and informative. Very expensive lesson to learn.

Jamie Cobb

Buyer beware at renewal. My wife’s policy went from $80 to $120 monthly. The renewal included increased maximums that skyrocketed our premiums. Then we were forced to call after an email exchange to fix what we never did change.

While we had it there were vet bills short paid or not covered. I wouldn’t deal with this company nor refer anybody I care about to do business here. Before you post it, save your condolences and care more for clients while they are patronizing you. It’s too late to change my view. Your customer care had many opportunities along the way.

Will Singley

They don’t cover other animals such as rabbits. Most of us can not afford a dog or cat because of the landlord. If they want to beat other insurance companies, they need to add other animals besides cats and dogs.

Yaeger Kertov Reaper

Conclusion

After checking off each aspect of this PetPartners pet insurance review, we’ll overview the most important takeaways that come by using PetPartners’ services.

Throughout our research, we discovered that PetPartners does offer a suitable insurance option to cover most pet’s needs, but only if you’re willing to pay more and acquire the additional riders. Their base coverage plan is a decent option, but it appears that if you rely only on that, you might face vet bills that you cannot be reimbursed for in the future.

We’ve heard great things about their customer service and we really appreciate their Basic option for accident and illness coverage. It offers great benefits for a truly affordable price. Their pet wellness tiers are also a smart way to provide preventative care for your pet and keep their needs in check.

Other than that, adding optional coverage plans will spike the price of your premium, making it a solution only wealthier people can afford to acquire. Limiting coverage for illnesses for pets that are only younger than 9 is quite restrictive in our opinion. There are many other options out there that are a lot more liberal in that regard.

To learn about everything available to pet parents concerning pet insurance and wellness care, visit our Protect My Paws blog and let us assist you in finding what’s best for you and your four-legged companions.

PetPartners’ Alternatives

One of the best alternatives to PetPartners is Wagmo. We decided they are a great substitute because, unlike PetPartners, Wagmo reimburses their policyholders with 100% of their vet bill costs and the money is deposited directly into their bank accounts within a single day. It’s also a big plus that Wagmo’s pricing model is absolutely transparent so you’re always in the know of what you can expect with them.

24PetWatch is great if you want short waiting periods. While PetPartners isn’t terrible in this regard, 24PetWatch has a waiting period of only 1 day for accidents and 3 days for illnesses. The process claims in a fast manner and the coverage options they offer are also a lot simpler than those provided by PetPartners.

Finally, Prudent Pet is the one to pay attention to if you’re hunting for options for senior pets. They impose no age restrictions, no lifetime or annual limits, and their discount options are on a better level than what PetPartners gives to their customers. However, they lack a mobile app which can be a bummer for those addicted to everything smart.

F.A.Q.

Will my pet be dropped from PetPartners insurance coverage after they turn 9?

While PetPartners doesn’t provide accident and illness coverage for pets older than 8, pets that have enrolled in that coverage plan won’t be dismissed after they turn 9 years old. Those pets can keep their pet insurance policies for life.

Does the AlternativePlus coverage plan cost extra to add to the base coverage?

All PetPartners base coverage plans come with the AlternativePlus add-on at no extra charge. This plan provides coverage for alternative and holistic treatments and treating behavioral issues as well. It is capped at $1,000 in benefits on an annual level.

Can my coverage face complications if I have gaps between policy periods?

If you don’t pay your PetPartners premiums in time you may face delays in your pet insurance coverage and some of your claims might be denied. You can contact PetPartners directly and see what they can do for you about this issue. If you have a gap when renewing a policy and your pet develops a condition during this period, this new condition can be considered as pre-existing when you renew your policy.

How can I receive my reimbursement once my claim has been approved?

At the moment, the only way to receive your reimbursement from PetPartners is through a check. They don’t offer direct deposit nor an option for a direct vet bill payment. So keep an eye on your mailbox.

When and how can I cancel my PetPartners pet insurance policy?

If you wish to cancel your PetPartners insurance policy you may do so whenever you want. Simply call their representatives at 1-866-774-1113 and follow their instructions.